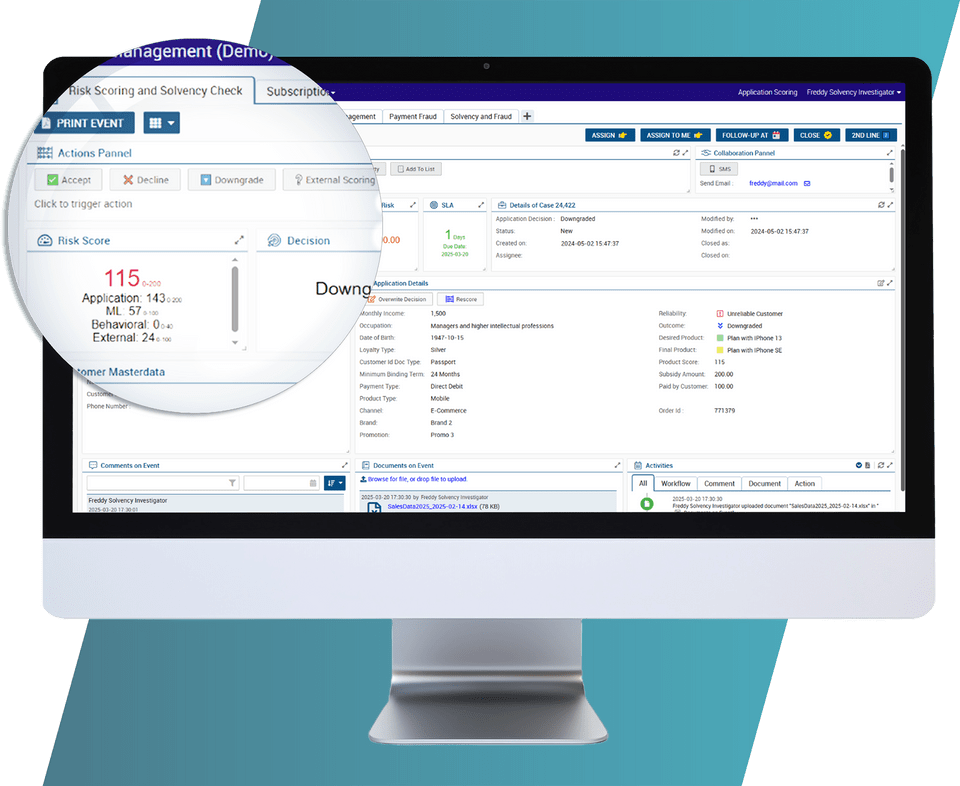

Telecom providers must balance risk and revenue while scaling efficiently. RiskShield’s AI-powered, SaaS-based Credit Risk Scoring simplifies this challenge with real-time, automated decisioning – reducing bad debt, increasing approvals, and optimizing customer acquisition.

Why RiskShield:

- Instant credit risk assessment: Approve, decline, or adjust offers in milliseconds.

- Better acceptance rates: Dynamically adapt offers instead of rejecting customers outright.

- Automated, AI-driven risk assessment: Reduce manual effort while ensuring accuracy.

- Cloud-based & future-proof: Scalable SaaS or on-premise solution, adaptable to evolving needs.

RiskShield enables telecom providers to streamline processes, boost revenue, and minimize financial risk – all in one flexible, AI-driven SaaS solution. Download our dedicated brochure to see how RiskShield can transform your credit risk strategy.